Life’s WORC Planned Giving Program

Deferred-Payment Gift Annuity

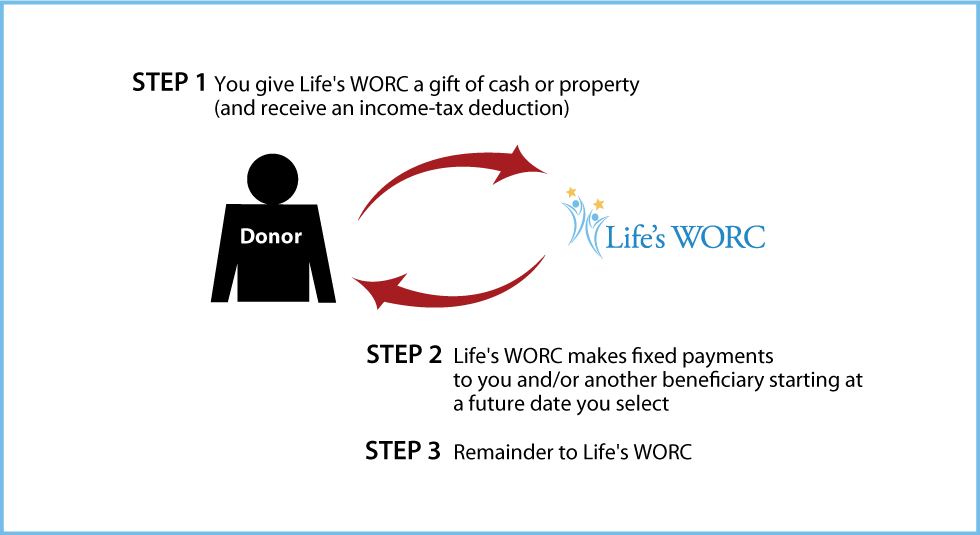

How It Works

- Transfer cash or other property to Life's WORC

- Life's WORC agrees to make payments for the life of one and up to two annuitants (payments are backed by our entire assets)

- The balance of the transfer inures to Life's WORC

Benefits

- Payments for life that are favorably taxed

- When gift is funded with cash, part of payment will be tax-free

- When gift is funded with appreciated property, part will be taxed as capital gain, part will be tax-free, and part will be taxed as ordinary income

- Federal income-tax deduction for a portion of your gift

- Gift will provide generous support for Life's WORC

More Information

Request an eBrochure

Request Calculation

Contact Us

Planned Giving Administrator |

Life’s WORC Federal Tax ID Number: 23-7209731 |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer